Source: Daniel Kahneman & Gary Klein, "Conditions for Intuitive Expertise: A Failure to Disagree" in American Psychologist (2009: 515-526)

The Context.

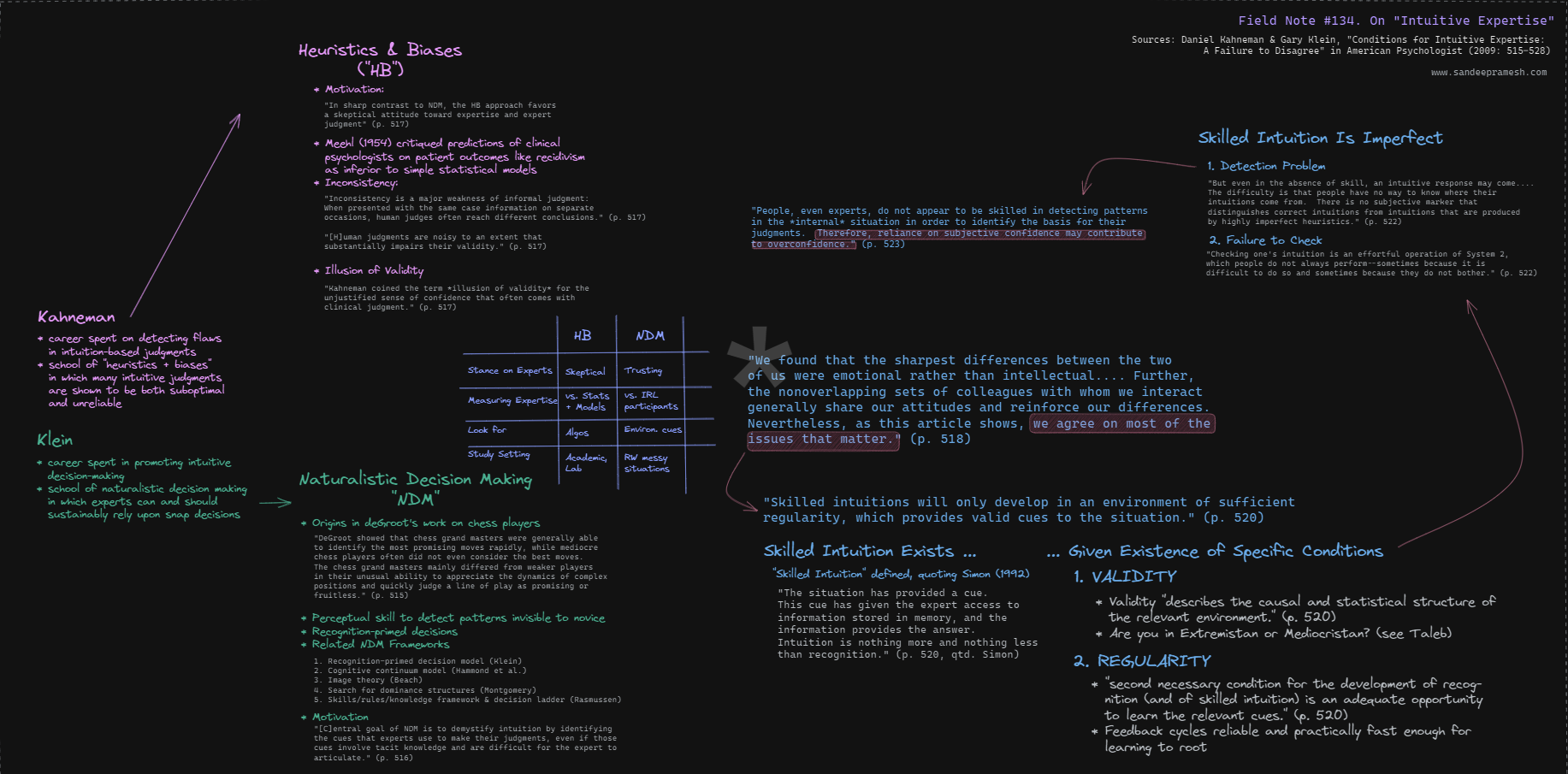

Kahneman spent his career detecting (mostly in lab setting) flaws in intuition-based judgments.

Klein spent his career promoting (mostly in real world settings) the validity of intuitive decision-making.

Where they converge has been more interesting to me than where they diverge.

Specifically:

" We found that the sharpest differences between the two of us were emotional rather than intellectual....Further, the nonoverlapping sets of colleagues with whom we interact generally share our attitudes and reinforce our differences. Nevertheless, as this article shows, we agree on most of the issues that matter." (p. 518)

The Venn diagram overlap is that "skilled intuition" (defined here as the retrieval of information from memory prompted by the observation of an external cue) exists but only under specific conditions.

An environment where skilled intuition can manifest must have high marks in the two following qualities:

1️⃣ Validity: the "causal and statistical structure of the relevant environment" (p. 520). Low validity environments are jagged, rough, messy, and unstable.

- In Knightian Terms: closer to uncertainty than to risk. See Field Note 16: On "Knightian Risk, Uncertainty, Profit (+ Crypto)"

- In Talebian Terms: walking in Extremistan (fat tailed, stochastic), not Mediocristan. See Field Note 95: On "Epistemic Arrogance, or Scandal of Prediction"

- In Mandelbrotian Terms: fractal and turbulent, not Gaussian. See Field Note 58: On "Mandelbrot's 10 Heresies of Finance"

- In Cynefin Terms: within the complex quadrant, perhaps drifting toward the chaotic zone. See Field Note 50: On "Cynefin and Complexity"

2️⃣ Regularity: reliable and practically useful evaluative feedback cycles.

- Duration is against you here.

A critical complication even when the conditions above are met is the "detection problem." Namely, "even in the absence of skill, an intuitive response may come....The difficulty is that people have no way to know where their intuitions come from. There is no subjective market that distinguishes correct intuitions that are produced by highly imperfect heuristics." (p. 522)

The Implications.

- Know in what environment you are in.

- Query: even in a terrain characterized by a strong form of Knightian uncertainty as not just unknown, but "unknowable", how might you circumscribe a nested environment that does have higher validity and regularity?

- Cultivate humility, which is effectively generated when you have invested for a sufficiently long period of time to lose and make a lot. You realize (beyond your wallet) the devastation of "epistemic arrogance."

- Research matters here, not so much as a need to "find the gold," but to avoid the fool's gold; viz., check and re-check the intuitive response, skilled as it may be, lest subjective confidence erode into overconfidence

- Position sizing appears defensive, but defense wins games where compounding exists. This defensive posture is often less attractive at cocktail parties (and other well-known digital places), but defense != passivity or "quitting the game." Referencing Spitznagel on the version of compounding as the most destructive force: "Your big losses would have determined your rate of compounding and put you on a path that made you wish for a different one." See Field Note 91: On "Thus Spake Spitz, or Amor Fati"

The Breadcrumbs.