Source: Benoit Mandelbrot & Richard Hudson, The (Mis)Behavior of Markets: A Fractal View of Financial Turbulence (2004), pp. 225-252

The Main Ideas.

Following Field Note $#57. On "Metaphor and Counter-Conventional Investing", how fitting to read the following, concerning financial markets from the fractal father himself:

"But it all comes together in the metaphor of turbulence."

(Id. at 228)

(Id. at 228)

Experiencing and understanding financial markets as turbulent generates 10 non-standard observations, according to the inimitable Mandelbrot.

- Markets = Turbulent. Against wishful thinking and financial orthodoxy (e.g., Gaussian, bell curve, normal distributions), financial markets display wild variation. Embrace convexity.

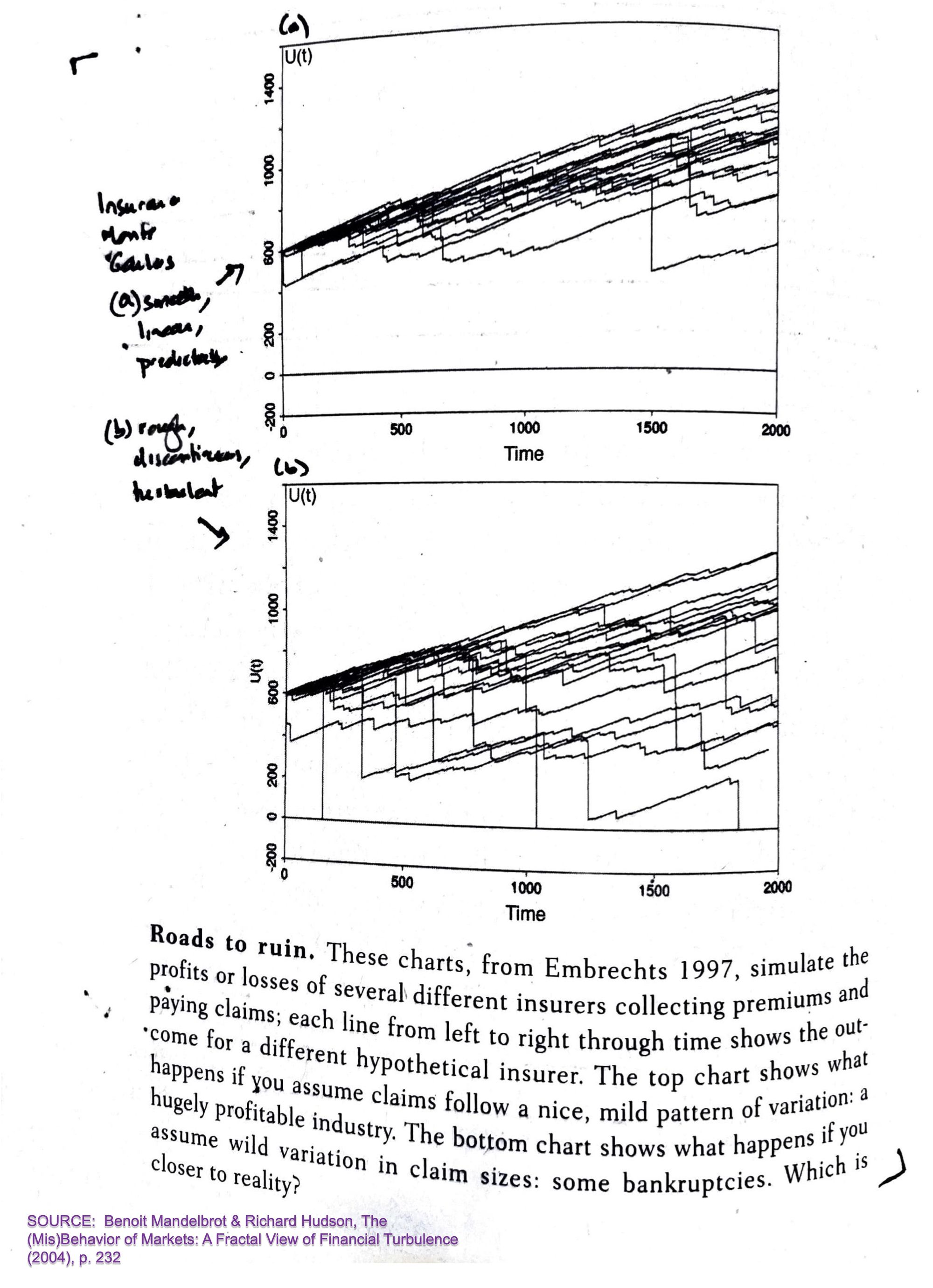

- Markets = Dangerous. It is easy and seductive to underestimate the extreme risk laden in financial markets. There is a strong observed tendency to pay lip service to "turbulence." It is also easy and seductive to ignore the difference between ensemble probability and time probability. It is the latter that actually matters to an individual.

- Timing Matters: Buy & Hold Is Illogical. Holding forever or "setting and forgetting" sounds either heroic / brave (in the first case) or lazy / defeatist (in the second case). Both are ignorant to the fact that volatility is concentrated; it clusters. The heuristic thus follows: take profits.

- Prices are Discontinuous. They Jump. These jumps are more pronounced in an age where information cascades are more frequent.

- Time Deforms. Market participants do not operate on some single universal clock or time scale.

- All Markets Are Built Upon Same Structure. Market processes change only in scale, but not in nature.

- Markets Are Uncertain; Bubbles Exist.

- Markets Are Deceptive. Acknowledge our tendency to look for faces in the clouds.

- Can't Forecast Prices, but Can Estimate Risk. "Markets are turbulent, deceptive, prone to bubbles, infested by false trends. It may well be that you cannot forecast prices. But evaluating risk is another matter entirely." (Id. at 247)

- Value Is Overvalued. "To be sure, I do not argue there is no such thing as intrinsic value....But the turbulent markets of the past few decades should have taught us, at the least, that value is a slippery concept, and one whose usefully is vastly over-rated." (Id. at 252)

An Image. Mind the Tails. Don't Disrespect the Risk of Ruin.

The Details.

The Bat Signal.

🚨 Is anyone working on Extreme Value Theory?

🤝 I'd love to contribute time, energy, and/or other resources to help develop its application to crypto trading/investing in particular.

Please connect!