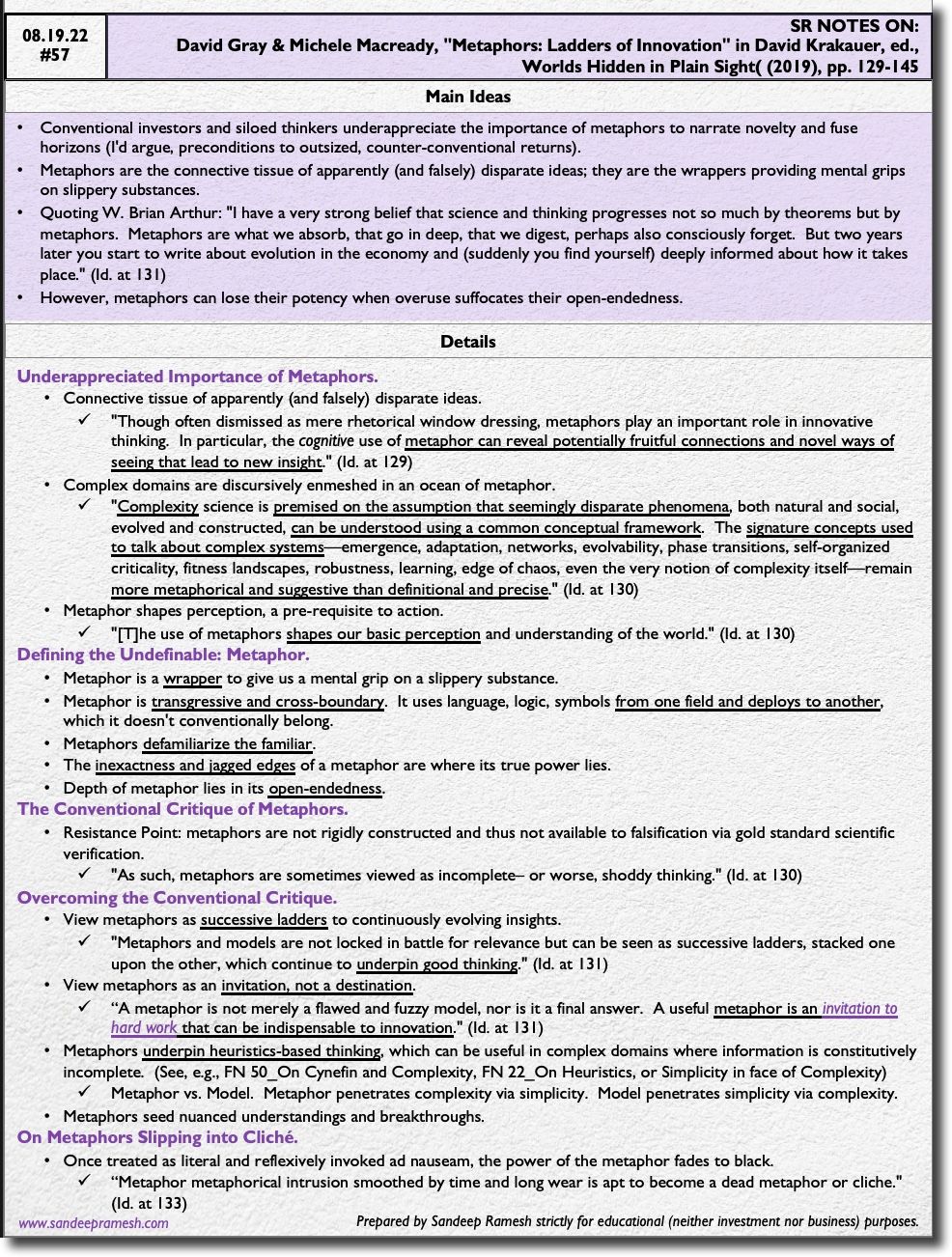

Source: David Gray & Michele Macready, "Metaphors: Ladders of Innovation" in David Krakauer, ed., Worlds Hidden in Plain Sight( (2019), pp. 129-145

Conventional investors and siloed thinkers underappreciate the importance of metaphors to narrate novelty and fuse horizons. I'd argue that an appreciation of metaphor is an unstated pre-condition to inviting outsized, counter-conventional returns.

Metaphors are the connective tissue of apparently (and falsely) disparate ideas; they are the wrappers providing mental grips on slippery substances typically found in complex domains (see e.g., Field Note #50). They invite multidisciplinary thinking, increasing the probability of seeing what the "crowd" doesn't.

Marcel Proust enters here:

And, quoting W. Brian Arthur: "I have a very strong belief that science and thinking progresses not so much by theorems but by metaphors. Metaphors are what we absorb, that go in deep, that we digest, perhaps also consciously forget. But two years later you start to write about evolution in the economy and (suddenly you find yourself) deeply informed about how it takes place." (Id. at 131, emphasis added)

However, metaphors can lose their potency when overuse suffocates their open-endedness.

In crypto broadly, but two examples: "Cambrian explosion" and "lego blocks." 🥱

🚨 CTA: What others? It would be fun to compile sharable list to see if our collective thinking is becoming stale :)