The silo song is strong...

The conventional appropriation of the Bruce Lee quote--"I fear not the one who has practiced 10,000 kicks once, but the one who has practiced one kick 10,000 times"--is often in service of promoting expertise at the expense of multidisciplinarity.

(The quote itself sets up a terribly false dichotomy for the sake of effect and rhetorical tidiness.)

... but the song is out of tune.

In domains where the terrain constantly shifts, a diligently practiced single move causes utter loss of one's footing. Does it not?

The "cult of the expert" is exposed by the irreverence displayed by the ground.

Anecdotally, I have noticed in conversations that critiques of blockchain (colloquially, an umbrella term encompassing web3 and crypto as well) tend to ignore the context in which such technology is situated. That is, the context of other technologies. These critiques are siloed, ignoring the terrain shifts where improvements in one area of the technological complex enables another.

Co-productivity. Co-extension. Inter-penetration.

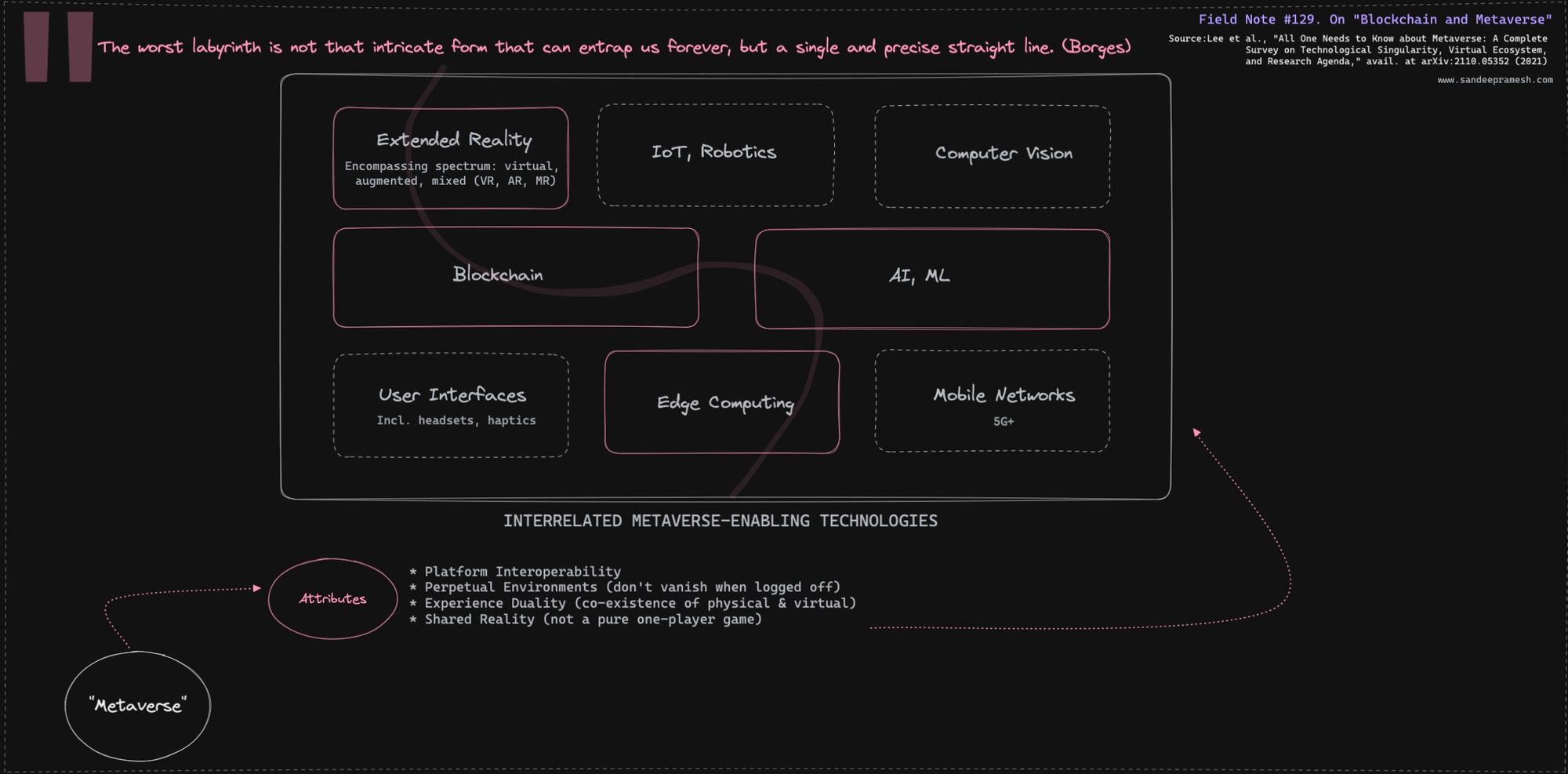

Taking the case of "metaverse"--noting the bruises this concept has been dealt in popular discourse--blockchain is but one enabling technology supporting a possibility of a gigantic, immersive, always-on, unified, shared, and perhaps even blended (that is, stitching physical and digital reality as co-extensive). Others include: Extended Reality, IoT, Computer Vision, Haptics, Edge Computing, Mobile Networks, and of course the current hashtag trender: AI/ML.

The Details.

On the idea of blockchain as part of a co-dependent technological environment enabling a "metaverse," see Lee et al., "All One Needs to Know about Metaverse: A Complete Survey on Technological Singularity, Virtual Ecosystem, and Research Agenda," avail. at arXiv: 2110.05352 (2021).

The essence is distilled in the attached map, but the lingering thirst is best satisfied by consulting the source material itself.

(Side Note:

Investment strategies tend to be siloed as a result of an "allocation syndrome," understood as a need to strictly classify, separate, and "control." Ironically, the imperative to divide and conquer (risk) in this way can quite stunningly lead to LTCM style system ruin.

This view also serves as a critique to the investment thesis in the "crypto community" to strictly and pristinely unbundle activities, functions, and layers of risk in some kind of technocratic utopianism.

/ fin)