Source: Gerd Gigerenzer, "The Adaptive Toolbox" in Gigerenzer & Selten, ed., Bounded Rationality (2001)

The Context.

"Heuristics in the adaptive toolbox are modeled on the actual cognitive abilities a species has rather than on the imaginary powers of omniscient demons." (Gigerenzer, 37: 2001)

The surface level critique of heuristics is that their use is a result of cognitive biases (often categorically treated as negative). And so, "[m]odels of rational decision making in economics, cognitive science, biology, and other fields, in contrast, tend to ignore these constraints [of limited time, knowledge, and computational capacity] and treat the mind as a Laplacean superintelligence equipped with unlimited resources" (Id.)

However, that critique ignores the complex environment in which those heuristics operate. As well, "heuristics maximalists" run the risk of ignoring that environments are often local ecologies requiring tuned heuristics, not general purpose, universally cross-functional ones.

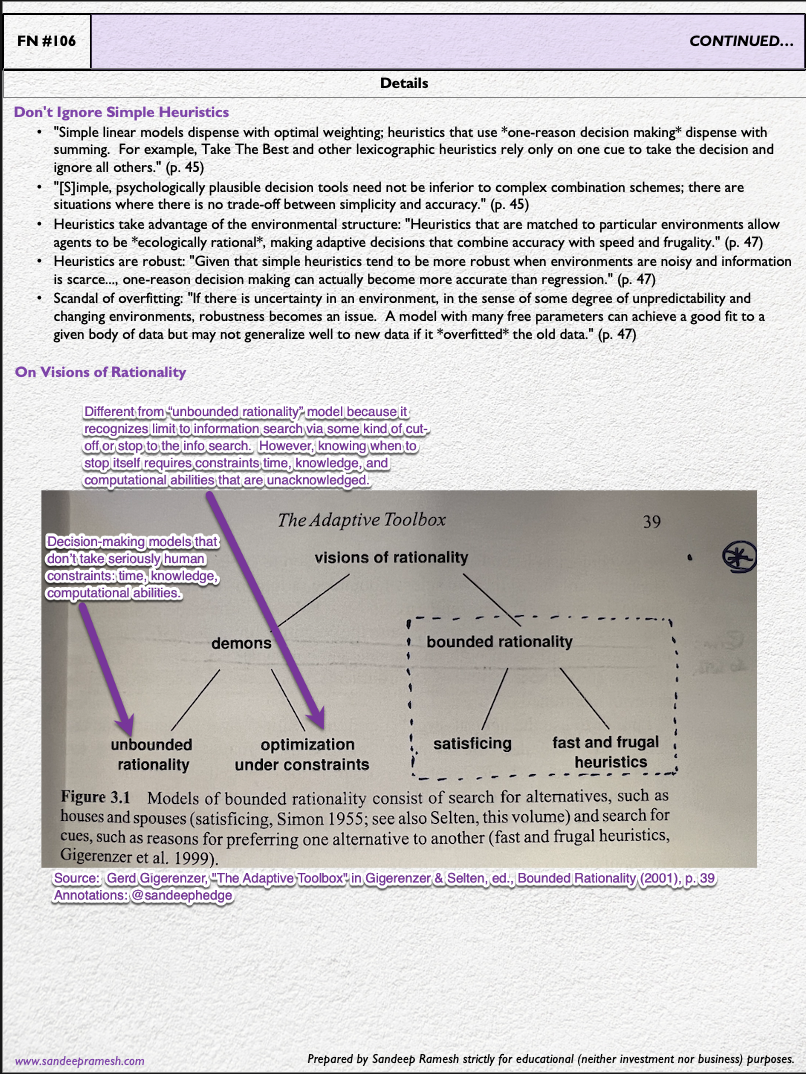

Against the naive cognitive theorist and the sloppy heuristics maxi, Gigerenzer advances a "specific vision of bounded rationality" based on (1) psychological plausibility; (2) domain specificity; and (3) ecological rationality.

This vision appears to present a "third way" (a better way) of seeing:

"The quest for psychological plausibility suggests looking into the mind, that is, taking account of what we know about cognition and emotion in order to understand decisions and behavior. Ecological rationality, in contrast, suggests looking outside the mind, at the structure of environments, to understand what is inside the mind. These research strategies are complementary, like digging a tunnel from two sides. However, the parties who dig from each side should meet at some point, and this has been a rare event, so far." (Id. at 39)

In my professional environment (investing, risk)--while it makes raising LP capital harder (a too-cynical personality would rephrase: "tricking LPs as the honest GPs fool themselves")--the truth appears that:

"simple heuristics tend to be more robust when environments are nosy and information is scarce [as in most all investment domains, including and especially early stage venture and crypto], one-reason decision making can actually become more accurate than regression" (Id. at 47)... because of:

1️⃣ Robustness ("no overfitting please!"); and

2️⃣ Exploiting the structure of the environment ("convexity please!").

🍷 This Note pairs well with:

- Field Note 50: On Cynefin and Complexity, dealing with the idea that different environments (obvious, complicated, complex, and chaotic), require different navigational tools.

- Field Note 22: On Heuristics, or Simplicity in face of Complexity, dealing with simple heuristics outperforming complicated and complex ones in noise-ridden domains

- Field Note 26: On N/1: dealing with simple heuristic for position sizing in specific context of constructing a stock portfolio

The Details.