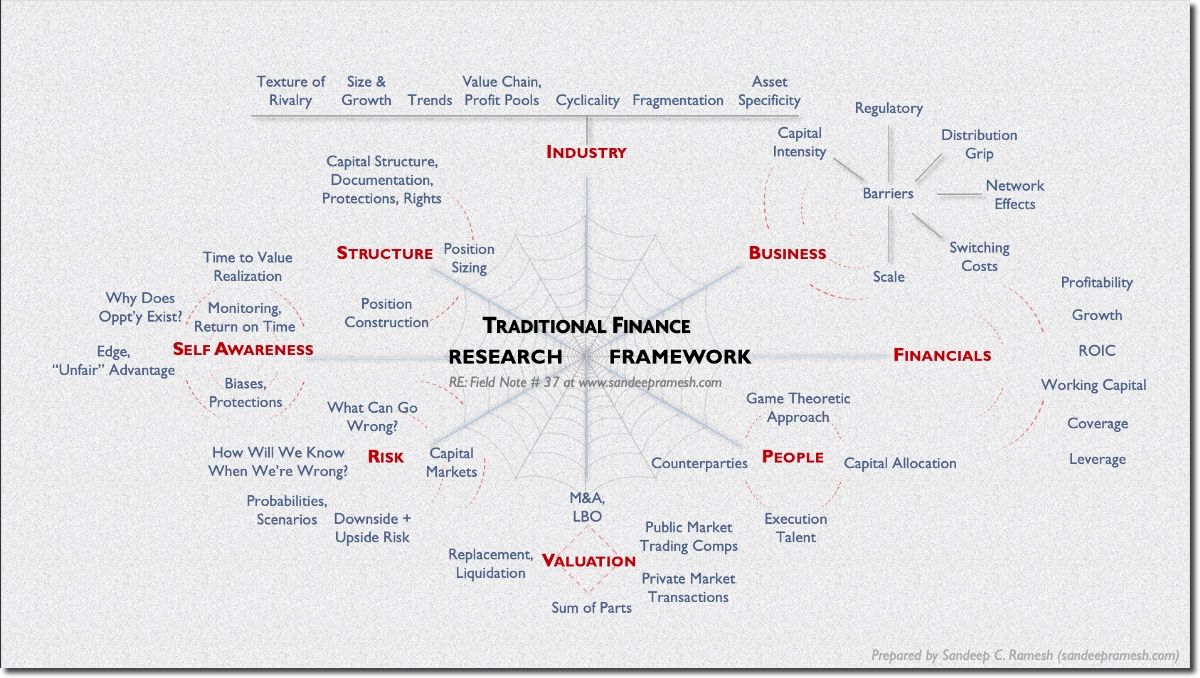

Source: Sandeep C. Ramesh circa. 2017 🤙🏽, see also Field Note 4.

A detailed investment framework is my hedge to info overload (see, e.g., Field Note 3 on "Info Smog").

I created this investment framework, used it at a multi-billion fundamental long/short hedge fund, and deploy elements of it in my own activities today.

Now, I'm working on a structured framework for crypto, web3, and related because:

A. "It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change." (Darwin)

B. “Nothing is built on stone; all is built on sand, but we must build as if the sand were stone.” (Borges)

C. Fun

Addendum: cleaner version of the above analytical framework sans details.

The question explored is what elements of this traditional finance framework might be genuinely applied to crypto investment evaluation (both liquid and illiquid situations).