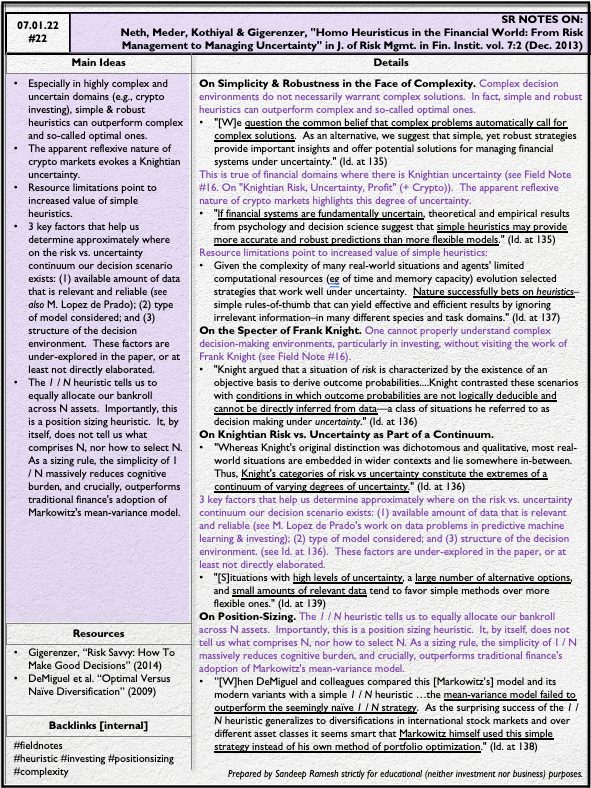

Source: Neth, Meder, Kothiyal & Gigerenzer, "Homo Heuristicus in the Financial World: From Risk Management to Managing Uncertainty" in J. of Risk Mgmt. in Fin. Instit. vol. 7:2 (Dec. 2013)

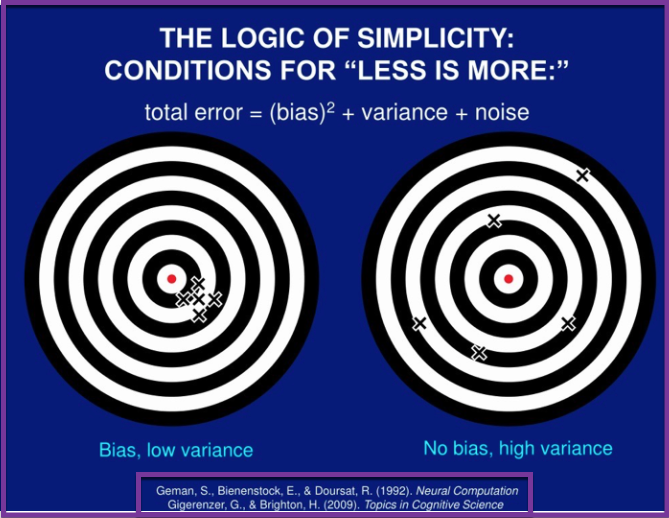

- Especially in highly complex and uncertain domains (e.g., crypto investing), simple & robust heuristics can outperform complex and so-called optimal ones.

- The apparent reflexive nature of crypto markets evokes a Knightian uncertainty (see Field Note #16. On "Knightian Risk, Uncertainty, Profit" (+ Crypto)).

- Resource limitations point to increased value of simple heuristics.

- 3 key factors that help us determine approximately where on the risk vs. uncertainty continuum our decision scenario exists:

(1) available amount of data that is relevant and reliable (see also M. Lopez de Prado);

(2) type of model considered; and

(3) structure of the decision environment. These factors are under-explored in the paper, or at least not directly elaborated. - The 1 / N heuristic tells us to equally allocate our bankroll across N assets. Importantly, this is a position sizing heuristic. It, by itself, does not tell us what comprises N, nor how to select N. As a sizing rule, the simplicity of 1 / N massively reduces cognitive burden, and crucially, outperforms traditional finance's adoption of Markowitz's mean-variance model.