Source: Richard Zeckhauser, "Investing in the Unknown and Unknowable" in Kennedy School of Gov't Faculty Research Working Paper Series (Feb. 2007)

The Context.

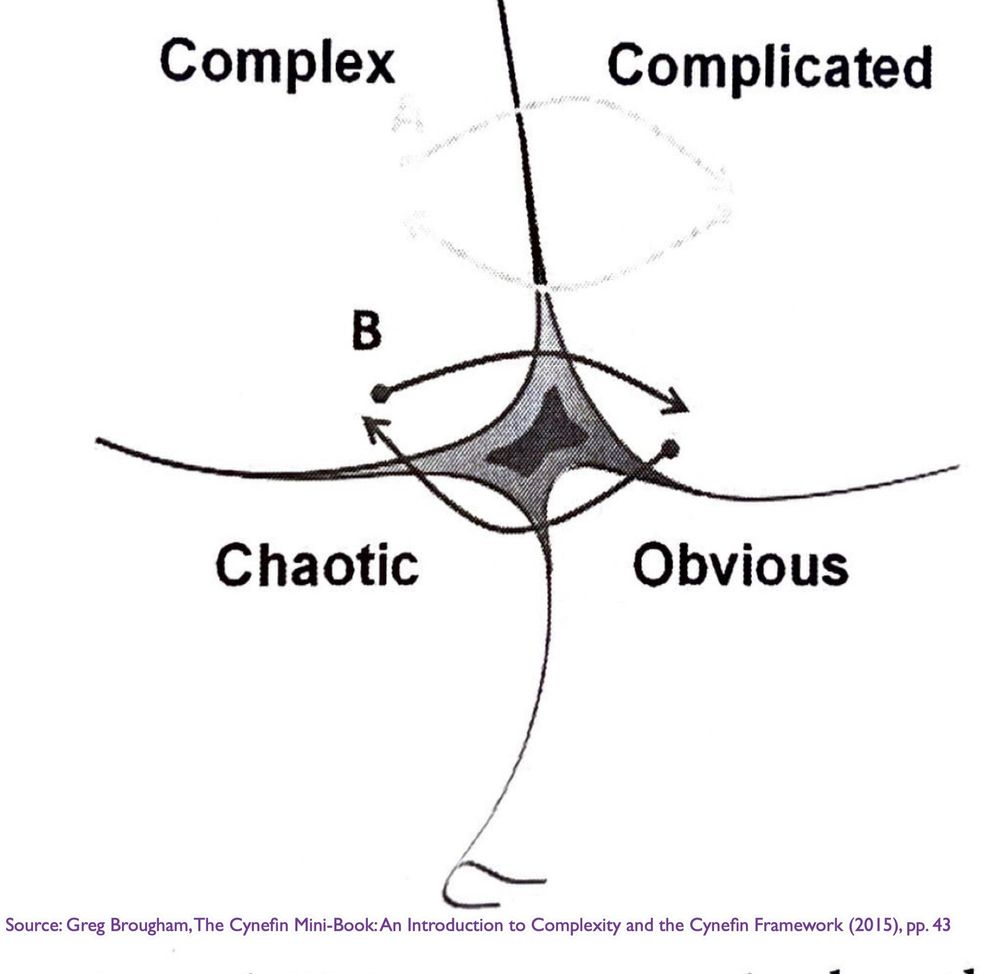

Field Note #50 (On "Cynefin and Complexity") re-presents a useful schema of (investment) environments:

My passion and obsession may be located at the border of the complex and the chaotic. And so, when I read this gateway question posed by Zeckhauser, I had to proceed:

"How to identify good investments when the level of uncertainty is well beyond that considered in traditional models of finance [?]" (p. 1)

The Warning.

"Do not read on...if blame aversion is a prime concern: the world of UU [uncertain + unknowable] is not for you. Consider this analogy. If in an unknowable world none of your bridges falls down, you are building them too strong. Similarly, if in an unknowable world none of your investments look foolish after the fact, you are staying too far away from the unknowable." (p. 4)

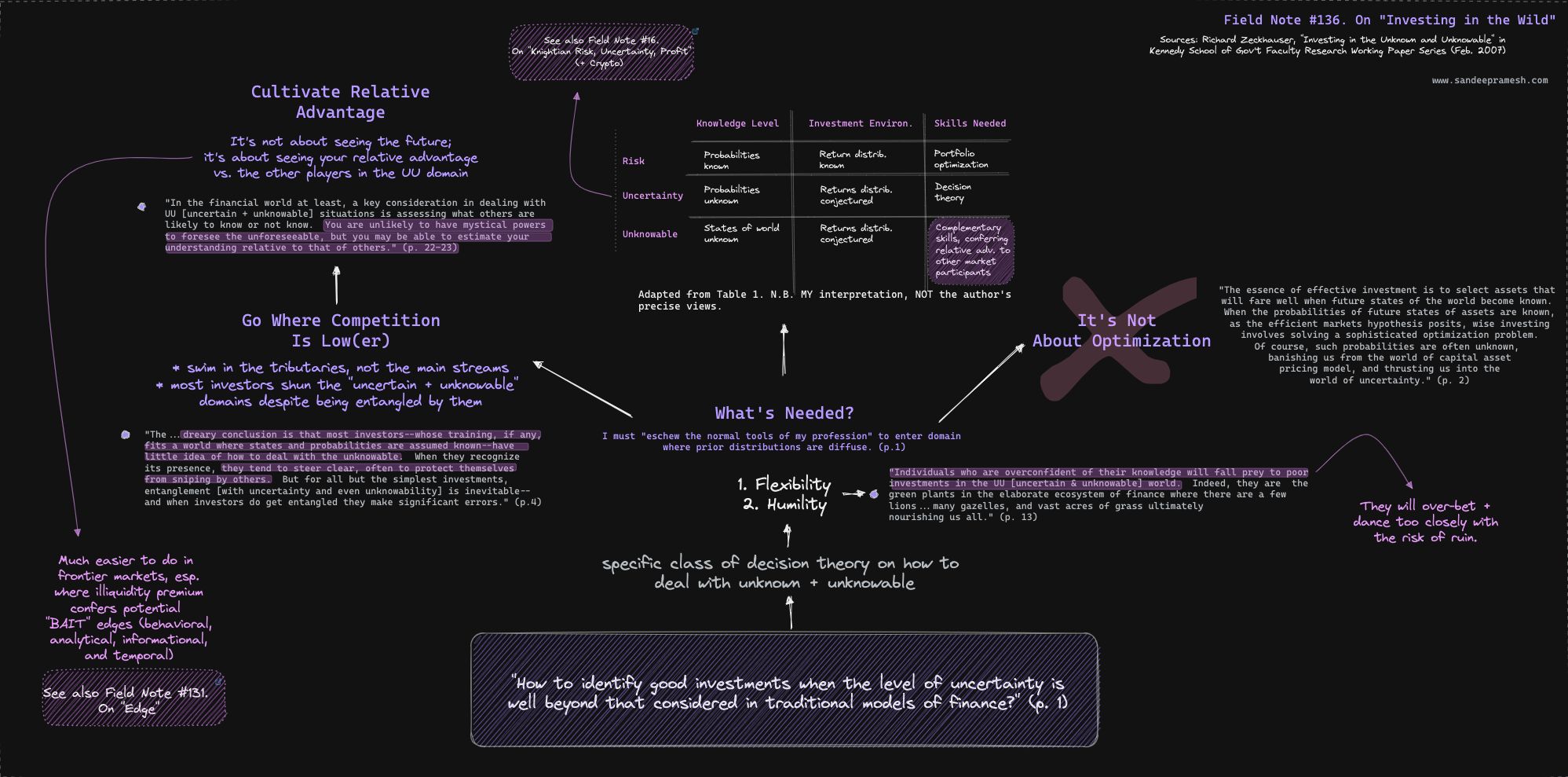

The Map.