Distillation of:

Field Note 17. On "Tail Risk x Crypto"

A Gloss.

In my experiences from the "rarified" hedge fund world, the insistence upon evaluating downside risk was axiomatic.

Words and phrases like margin of safety, protection, bidirectional (long/short), hedge, reflexivity, tail risk, edge (not social network, not proprietary flow), and non-cosmetic diversification were yawn-inducing because they were so obvious.

Whether or not executed or calibrated well is another issue.

The yawn can transform into a snore, leaving many asleep at the switch.

In my experiences in early stage venture, including liquid & illiquid crypto, the overwhelming tendency observed was an anchoring to the upside (or a paying of lip service to risk mitigation).

Conversations with venture investors (counterparts to the "hedgies") have tended to congeal around words and phrases like belief, vision, Midas, TAM, open-ended growth, "penetration is only 1% today," inevitability, double/triple/quadruple down, and escape velocity.

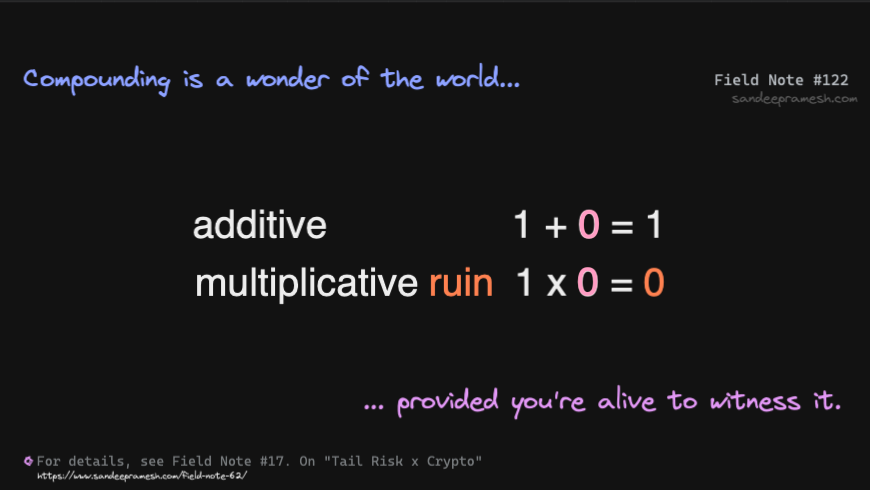

What seems clear is that survival is a precondition to success.

To realize the wondrous convexity of a high octane asset class (e.g., early stage venture, crypto, etc.) with a wide probability space, the axiom of axioms is that you must be financially (and otherwise) alive.

A Sketch.