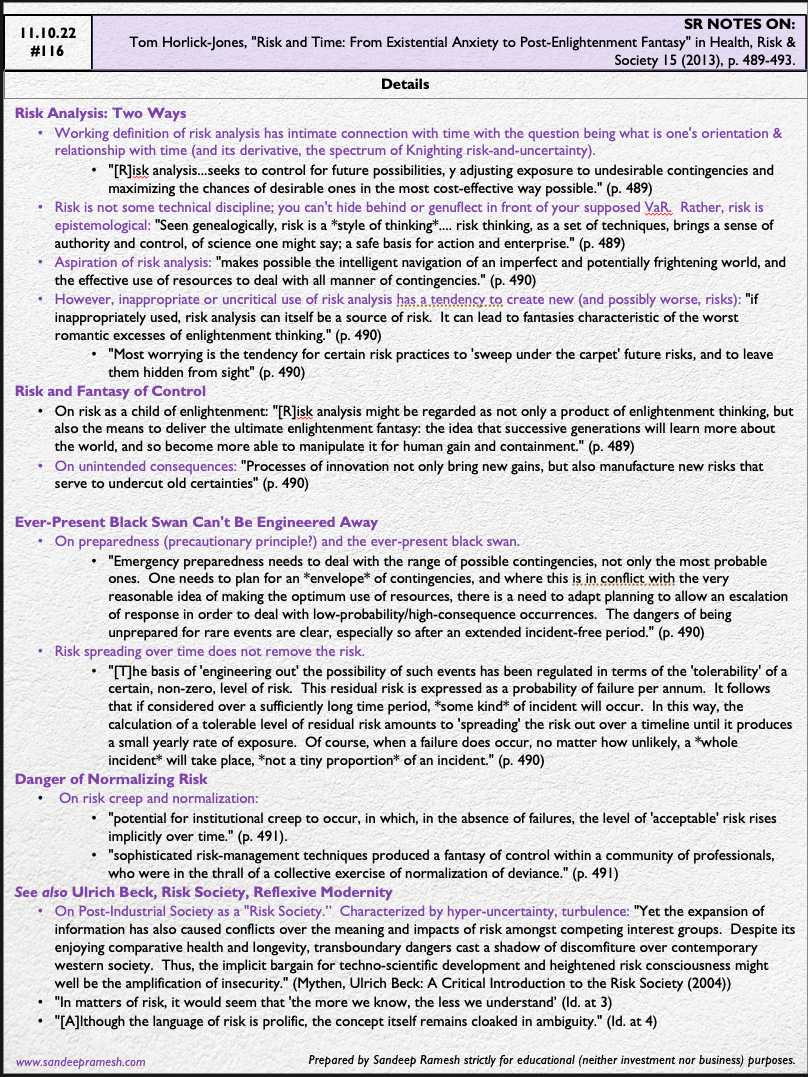

Source: Tom Horlick-Jones, "Risk and Time: From Existential Anxiety to Post-Enlightenment Fantasy" in Health, Risk & Society 15 (2013), p. 489-493

A Personal Context.

In Field Note #101: On "Metacrisis + Crypto (part 2)," I claimed that risk had become my boundary object, the substrate that supports exploration of all areas of personal & professional interest, including and especially investing.

Most investors, entrepreneurs, and professed risk-takers seem to pay lip service to risk. I am still rather perplexed that no one had even mentioned Frank Knight's essential work (see Field Note #16: On "Knightian Risk, Uncertainty, Profit") at the "fancy pants" institutions where I had sojourned.

So, perhaps these Notes that deepen my appreciation (if not understanding) of risk serve to make up for missed opportunity. Or perhaps the lost time has actually served to concentrate my mind and sharpen my sense of responsibility (from the ground, not a high horse) for what to do about the pervasive risk ignorance, at a minimum in the investing domain, but hopefully beyond.

Thanks for indulging the brief personal detour.

Some Key Ideas.

- Risk Creep.

Uncle point goes up (see Field Note #91 that introduces the pragmatic necessity of knowing one's uncle point). An "important lesson...lies in the potential for institutional creep to occur, in which, in the absence of failures, the level of 'acceptable' risk rises implicitly over time" (p. 491).

This is seen in a normalization of reckless risk seeking (from the venture incentives to "break stuff" to liquid crypto hedge fund managers casually dismissing 80%+ drawdowns as "oh that's crypto, NBD").

In fact, the irony might be that when failures actually occur, the risk creep in certain corridors (venture? crypto?) intensifies ("that's a failure of the traditional world; double down here"). - Risk Sweep.

What domain is the following description about?

Hint: there is more than one.

"The tendency towards risk analysis becoming a rhetoric that serves to obscure a source of residual risk that is portrayed as negligible was responsible for perhaps the most significant failure in recent years....It is difficult to find a better example of how ostensibly sophisticated risk-management techniques produced a fantasy of control within a community of professionals, who were in the thrall of a collective exercise of normalization of deviance." (p. 491, emphasis added)

The Details.